Prioritize

- Due to supply chain problems and environmental problems, Tesla Powertrain is trying to remove Rare-earth magnet from motors and looking for alternatives.

- Tesla has not yet invented a completely new magnet material, so it may make do with existing technology, most likely using cheap and easily manufactured ferrite.

- By carefully positioning ferrite magnets and adjusting other aspects of motor design, many performance indicators of rare earth drive motors can be replicated. In this case, the weight of the motor only increases by about 30%, which may be a small difference compared to the overall weight of the car.

- New magnet materials need to have the following three basic characteristics: 1) they need to have magnetism; 2) Continue to maintain magnetism in the presence of other magnetic fields; 3) Can withstand high temperatures.

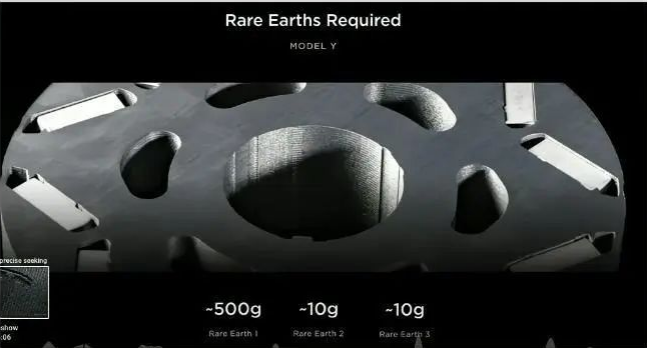

According to Tencent Technology News, electric vehicle manufacturer Tesla has stated that rare earth elements will no longer be used in its car motors, which means that Tesla’s engineers will have to fully unleash their creativity in finding alternative solutions.Last month, at Tesla Investor Day, Elon Musk released the “third part of the master plan”. Among them, there is a small detail that has caused a sensation in the field of physics. Colin Campbell, a senior manager of Tesla Powertrain, announced that his team was removing Rare-earth magnet from motors, because the supply chain problems and the negative impact of Rare-earth magnet production were too large.To achieve this goal, Campbell presented two slides involving three mysterious materials cleverly labeled as rare earth 1, rare earth 2, and rare earth 3. The first slide represents Tesla’s current situation, where the amount of rare earths used by the company in each vehicle ranges from half a kilogram to 10 grams. On the second slide, the usage of all rare earth elements has been reduced to zero.For magnetologists who study the magical power generated by electronic motion in certain materials, the identity of rare earth 1 is easily recognizable, which is neodymium. When added to common elements such as iron and boron, this metal can help create a strong, always on magnetic field. But few materials have this quality, and even fewer rare earth elements generate magnetic fields that can move Tesla cars weighing over 2000 kilograms, as well as many other things from industrial robots to fighter jets. If Tesla plans to remove neodymium and other rare earth elements from the motor, which magnet will it use instead?

For physicists, one thing is certain: Tesla did not invent a completely new type of magnetic material. Andy Blackburn, executive vice president of strategy of NIron Magnetics, said: “For more than 100 years, we may only have a few opportunities to get new business magnets.” NIron Magnetics is one of the few start-ups that try to seize the next opportunity.

Blackburn and others believe it is more likely that Tesla has decided to make do with a much smaller magnet. Among many possibilities, the most obvious candidate is ferrite: a ceramic composed of iron and oxygen, mixed with a small amount of metal such as strontium. It is both cheap and easy to manufacture, and since the 1950s, refrigerator doors around the world have been manufactured in this way.

However, in terms of volume, the magnetism of ferrite is only one tenth of that of Neodymium magnet, which raises a new problem. Elon Musk, CEO of Tesla, has always been known for being uncompromising, but if Tesla wants to turn to ferrite, it seems that it must make some concessions.

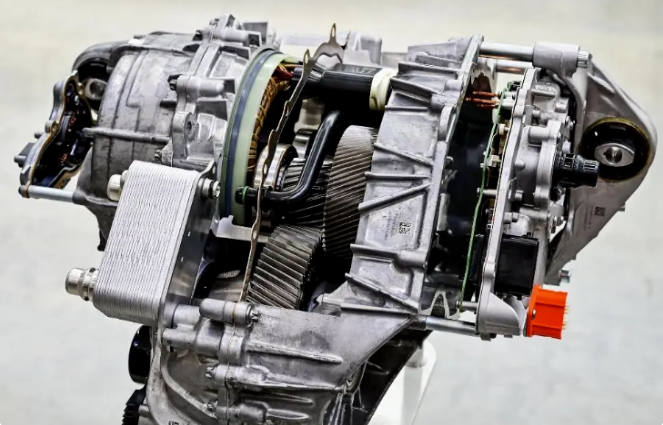

It is easy to believe that batteries are the power of electric vehicles, but in reality, it is electromagnetic driving that drives electric vehicles. It is no coincidence that both Tesla Company and the magnetic unit “Tesla” are named after the same person. When electrons flow through the coils in a motor, they generate an electromagnetic field that drives the opposite magnetic force, causing the motor’s shaft to rotate with the wheels.

For the rear wheels of Tesla cars, these forces are provided by motors with permanent magnets, a strange material with a stable magnetic field and no current input, thanks to the clever spin of electrons around atoms. Tesla only started adding these magnets to cars about five years ago, in order to extend range and increase torque without upgrading the battery. Prior to this, the company used induction motors manufactured around electromagnets, which generate magnetism by consuming electricity. Those models equipped with front motors are still using this mode.

Tesla’s move to abandon rare earths and magnets seems a bit strange. Car companies are often obsessed with efficiency, especially in the case of electric vehicles, where they are still trying to persuade drivers to overcome their fear of range. But as car manufacturers begin to expand the production scale of electric vehicles, many projects that were previously considered too inefficient are resurfacing.

This has prompted car manufacturers (including Tesla) to produce more cars using Lithium iron phosphate (LFP) batteries. Compared to batteries containing elements such as cobalt and nickel, these models often have shorter range. This is an older technology with greater weight and lower storage capacity. At present, the Model 3 powered by low-speed power has a range of 272 miles (approximately 438 kilometers), while the remote Model S equipped with more advanced batteries can reach 400 miles (640 kilometers). However, the use of Lithium iron phosphate battery may be a more sensible business choice, because it avoids the use of more expensive and even politically risky materials.

However, Tesla is unlikely to simply replace magnets with something worse, such as ferrite, without making any other changes. Alena Vicina, a physicist at Uppsala University, said: “You will carry a huge magnet in your car.” Fortunately, the motor is a rather complicated machine, which is composed of many other parts. Theoretically, it can be rearranged to reduce the impact of using weaker magnets.

In computer models, material company Proterial recently determined that many performance indicators of rare earth drive motors can be replicated by carefully positioning ferrite magnets and adjusting other aspects of motor design. In this case, the weight of the motor only increases by about 30%, which may be a small difference compared to the overall weight of the car.

Despite these headaches, car companies still have many reasons to abandon rare earth elements, provided they can do so. The value of the entire rare earth market is similar to that of the egg market in the United States, and theoretically, rare earth elements can be mined, processed, and converted into magnets worldwide, but in reality, these processes present many challenges.

Mineral analyst and popular rare earth observation blogger Thomas Krumer said, “This is a $10 billion industry, but the value of products created each year ranges from $2 trillion to $3 trillion, which is a huge lever. The same goes for cars. Even if they only contain a few kilograms of this substance, removing them means that cars can no longer run unless you are willing to redesign the entire engine

The United States and Europe are trying to diversify this supply chain. The California rare earth mines, which were closed in the early 21st century, have recently reopened and currently supply 15% of the world’s rare earth resources. In the United States, government agencies (especially the Department of Defense) need to provide powerful magnets for equipment such as airplanes and satellites, and they are enthusiastic about investing in supply chains domestically and in regions such as Japan and Europe. But considering cost, required technology, and environmental issues, this is a slow process that can last for several years or even decades.

At the same time, the demand for embedding magnets in decarbonization tools such as cars and wind turbines is also increasing. According to data from market research firm Adamas Intelligence, currently 12% of rare earths are used in electric vehicles, which is a nascent market. At the same time, rare earth prices often experience drastic fluctuations, and external companies are often unable to predict these factors.

Jim Cherikowski, a physicist who studies magnetic materials at the University of Texas at Austin, said that in a word, if you can find alternative products in your industry, it may be of great significance. But he said there are various reasons to look for better alternatives to Rare-earth magnet than ferrite. The challenge lies in finding materials with three basic characteristics: 1) requiring magnetism; 2) Continue to maintain magnetism in the presence of other magnetic fields; 3) Can withstand high temperatures. A hot magnet is no longer a magnet.

Researchers are very clear about which chemical elements can make good magnets, but there are millions of potential atomic arrangements. Some so-called magnet hunters start with hundreds of thousands of possible materials, eliminate those containing defects such as rare earths, and then use machine learning to predict the magnetism of the remaining materials. At the end of last year, Cherikowski and others used the system to manufacture a new type of high magnetic material containing cobalt.

The biggest challenge is usually finding new magnets that are easy to manufacture. Vicina of Uppsala University explained that some newly developed magnets, such as those containing manganese, are promising but unstable. In other cases, scientists know that a material has extremely strong magnetism but cannot be mass-produced. They include tetragonal pyroxene, a nickel iron compound found only in meteorites. It must undergo thousands of years of slow cooling to accurately arrange its atoms to the correct state. In the laboratory, efforts are underway to accelerate this process, but results have not yet been achieved.

Magnet startup Niron has gone further in this area. The company stated that its nitride iron magnets are theoretically more magnetic than neodymium. But it is also a volatile material that is difficult to manufacture and preserve in an ideal form. Blackburn said that the company was making progress, but could not produce magnets strong enough for Tesla’s next generation cars. He said the first step is to incorporate this new magnet into smaller devices such as audio systems.

Mineral analyst and popular rare earth observation blogger Thomas Krumer said it is currently unclear whether other automakers will follow Tesla’s move to abandon rare earths. Some companies may insist on using mature materials, while others may use induction motors or try new things. Even Tesla may use a few grams of rare earths in future cars, scattered in areas such as power windows, power steering, and windshield wipers.

At Tesla’s Investor Day event, the slide comparing rare earth content actually compares a whole current generation car with a future motor, which may be a Publicity stunt. Alternatives like Tesla are being developed, and replacing rare earth materials in motors may be a good thing, but as Krumer said, “I’m afraid we don’t have enough time!

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.